20%

Self-Funded Groups

can save up to 20%.

81%

Of large groups (200+)

81% were self-funded in 2014.

15%

Of small groups (3-199)

only 15% were self-funded in 2014.

30%

Up to 30% of small groups (3-199)

would benefit from self-funding.

Why Choose Us

The Current Problem:

Employers are facing the ever increasing, unsustainable costs of providing health benefits to their employees.

The Affordable Care Act (ACA) has only exacerbated the issue for large groups by adding new taxes and fees. Also, for groups with 51-100 employees, the ACA may force groups into community rated pools which will increase premiums for most employers.

The Risk Vantage Solution:

Risk Vantage employs a proprietary algorithm to measure the unique risk associated with the employer group. The results of this algorithm inform employers about the future expectation of their medical expense relative to their peers.

Currently, it is common for groups to be evaluated and priced based on the outdated and overly simplistic approach using underwriting factors such as SIC and demographics. SIC factors have been used for years as a key component of pricing formulas despite the fact that they have proven to have extremely limited ability to predict costs for a particular employer group.

About Us

The founding partners at Risk Vantage together bring over 40 years of experience at health plans and brokers. The health plan experience includes management of underwriting, actuarial and informatics functions at prominent health insurance carriers. The broker experience includes formation and management of multi-employer trusts.

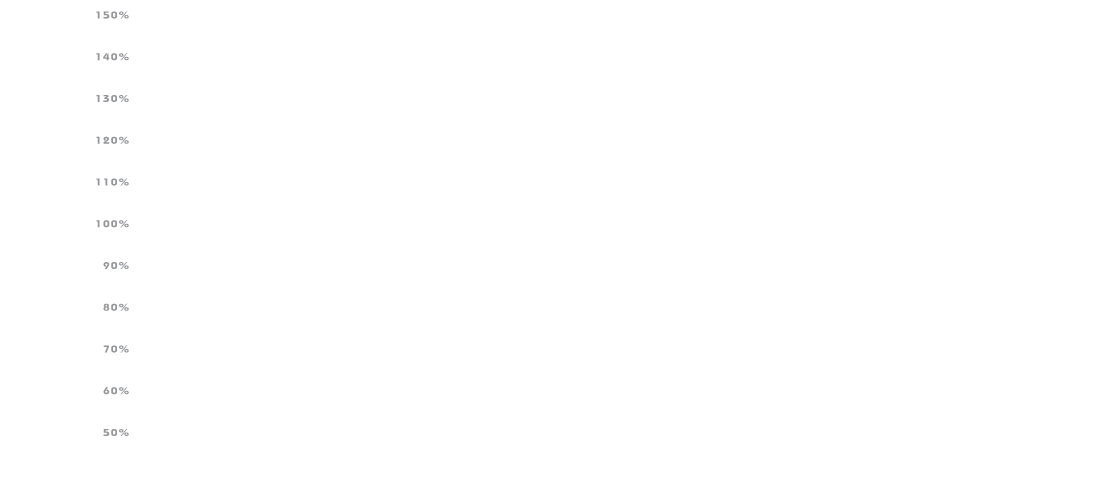

Health Insurance Tax*

2014 :: $8 Billion

2015 :: $11.3 Billion

2016 :: $11.3 Billion

2017 :: $13.9 Billion

2018 :: $14.3 Billion

This graph shows the Federal tax increase year over year, which amounts to 3% - 4% of your group premium.

*These taxes DO NOT apply to self-funded plans. Risk Vantage's assessment tools will evaluate whether or not it is feasable for a group to go self-funded, thus avoiding these federal tax increases.